For new investors, managing a house rehab can pose a major challenge. If you don’t happen to be a general contractor yourself, this renovation process likely seems like an insurmountable obstacle. As such, new investors often ask me how to manage a house rehab.

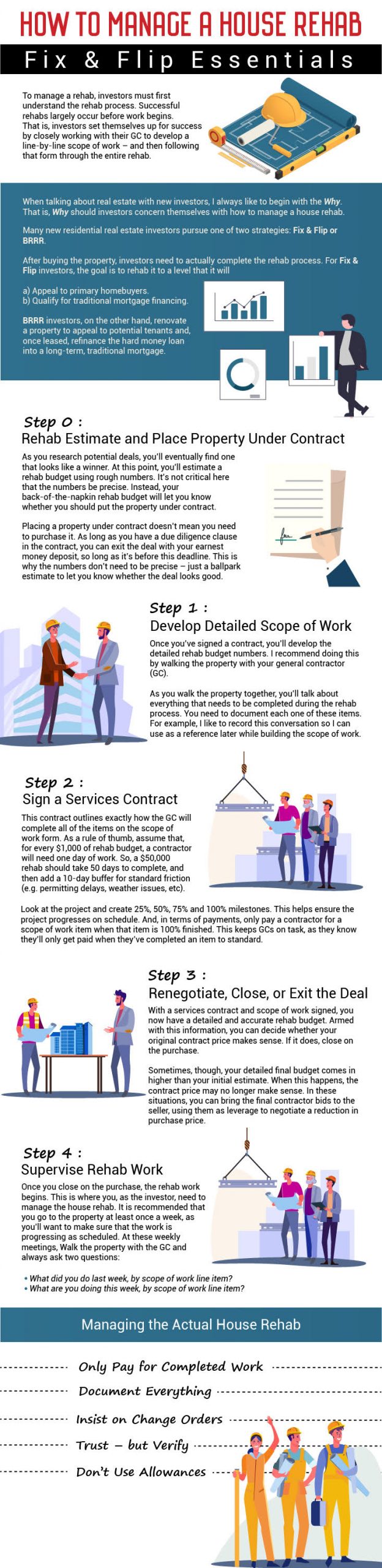

To manage a rehab, investors must first understand the rehab process. Successful rehabs largely occur before work begins. That is, investors set themselves up for success by closely working with their GC to develop a line-by-line scope of work – and then following that form through the entire rehab.

I’ll use the rest of the article to talk about the ins and outs of managing a house rehab. Specifically, I’ll dive into the following topics:

- Why House Rehabs Matter to Investors

- An Overview of the House Rehab Process

- What Rehab Work Adds the Most Value?

- Managing the Actual House Rehab

- How The Investor's Edge Can Help

- Final Thoughts

Why House Rehabs Matter to Investors

When talking about real estate with new investors, I always like to begin with the why. That is, why should investors concern themselves with how to manage a house rehab.

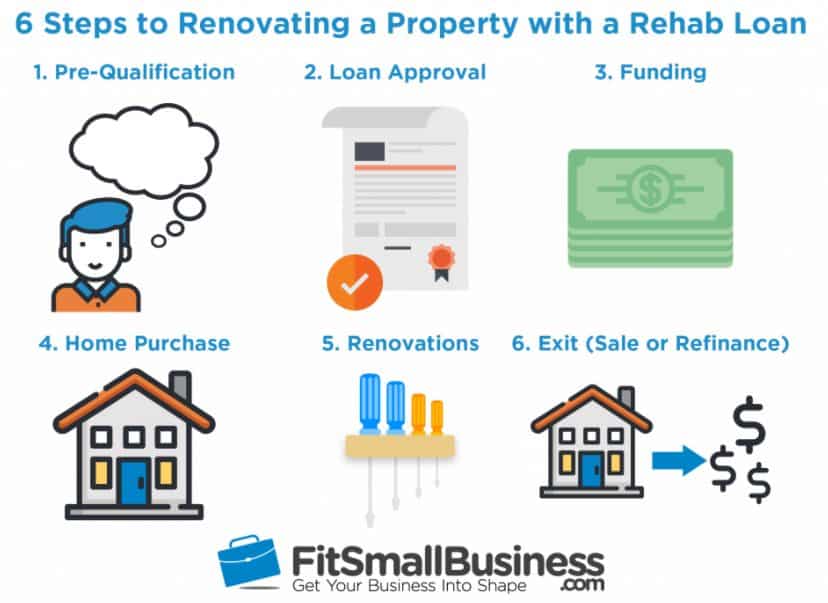

Many new residential real estate investors pursue one of two strategies: fix & flip or BRRR. Both of these strategies largely follow the above 6-step renovation diagram. That is, with each strategy, investors first need to confirm financing, generally through a hard money lender. Next, investors need to find a qualifying property, typically a distressed one that can be purchased at a deep discount.

After buying the property, investors need to actually complete the rehab process. For fix & flip investors, the goal is to rehab it to a level that it will A) appeal to primary homebuyers, and B) qualify for traditional mortgage financing. BRRR investors, on the other hand, renovate a property to appeal to potential tenants and, once leased, refinance the hard money loan into a long-term, traditional mortgage.

Regardless of which of the above routes investors take, the rehab portion of the deal comprises a major portion of the deal’s total costs. In some deals, the rehab may even cost more than the property acquisition. Accordingly, a successful rehab can keep costs at budget, leading to a profitable deal. Conversely, a poorly managed rehab can bust your budget, eventually cutting into – or erasing – a deal’s profit.

Recognizing this reality, successful investors understand the importance of closely and effectively managing the rehab portion of a deal. It doesn’t matter how good of a deal it seems like on paper, if you don’t properly manage the house rehab, your actual costs will likely exceed your budgeted costs, potentially turning a great deal into a money pit.

How to Manage a House Rehab

“How Much Does It Cost to Rehab a House”

Before diving into how to manage a house rehab, I need to provide an actual overview of the rehab process. I firmly believe that, to truly succeed as a real estate investor, you need to both understand the A) nitty gritty details, and B) where those details fit into the “big picture.” In other words, investors tend to be more successful when they understand why they’re doing something – not just what they need to do. With that said, here’s an overview of the major steps in a house rehab.

Rehab Step 0: Rehab Estimate and Place Property Under Contract

I list this as Step 0, because you’ll complete this work before you know whether or not you’ll pursue the deal. As you research potential deals, you’ll eventually find one that looks like a winner. At this point, you’ll estimate a rehab budget using rough numbers. It’s not critical here that the numbers be precise. Instead, your back-of-the-napkin rehab budget will let you know whether you should put the property under contract.

Of note, placing a property under contract doesn’t mean you need to purchase it. As long as you have a due diligence clause in the contract, you can exit the deal with your earnest money deposit, so long as it’s before this deadline. This is why the numbers don’t need to be precise – just a ballpark estimate to let you know whether the deal looks good.

Rehab Step 1: Develop Detailed Scope of Work

Once you’ve signed a contract, you’ll develop the detailed rehab budget numbers. I recommend doing this by walking the property with your general contractor (GC). As you walk the property together, you’ll talk about everything that needs to be completed during the rehab process. And, you need to document each one of these items (NOTE: I like to record these conversations on my phone, as I can use this as a reference when I’m building the below scope of work).

Once you’ve completed the walkthrough, you’ll document every single item in what’s known as a scope of work form. This form will include a line-by-line description of every task to be completed, the quality of the associated materials, and – eventually – the cost per item.

After you’ve added the tasks and materials to the scope of work form, you’ll meet with two contractors to have a pricing meeting. During these meetings, you’ll assign costs to each of the line items in the scope of work. The total cost for all of these items becomes your rehab budget. And, I recommend meeting with two contractors for pricing bids to solidify a primary and back-up contractor. This will give you flexibility during the rehab process in case one of the contractors A) doesn’t perform, or B) needs to back out for unforeseen circumstances.

Additionally, meeting with two contractors confirms you’re fair market pricing the project. You don’t want one contractor to significantly underbid and then nickel and dime you throughout the rehab. By getting two bids, you’ll have a clear sense of market pricing.

Once you confirm pricing, both you and the primary contractor will sign the scope of work form. That way, if you have any discrepancies in the future, this form will serve as the final arbiter.

Rehab Step 2: Sign a Services Contract

With a scope of work form signed, you now need to sign a services contract with your GC. This contract outlines exactly how the GC will complete all of the items on the scope of work form. As a rule of thumb, I assume that, for every $1,000 of rehab budget, a contractor will need one day of work. So, a $50,000 rehab should take 50 days to complete, and then I add a 10-day buffer for standard friction (e.g. permitting delays, weather issues, etc.).

Additionally, I recommend dividing the scope of work items into key milestones. Typically, I’ll look at the project and create 25%, 50%, 75% and 100% milestones. This helps ensure the project progresses on schedule. And, in terms of payments, I will only pay a contractor for a scope of work item when that item is 100% finished. This keeps GCs on task, as they know they’ll only get paid when they’ve completed an item to standard.

Of note, all of this occurs before you purchase the home.

Rehab Step 3: Renegotiate, Close, or Exit the Deal

With a services contract and scope of work signed, you now have a detailed and accurate rehab budget. Armed with this information, you can decide whether your original contract price makes sense. If it does, close on the purchase.

Sometimes, though, your detailed final budget comes in higher than your initial estimate. When this happens, the contract price may no longer make sense. In these situations, you can bring the final contractor bids to the seller, using them as leverage to negotiate a reduction in purchase price. Most motivated sellers will work with you and adjust the selling price. If not, you can still walk away from the deal with your earnest money, so long as you meet the due diligence period deadline.

Rehab Step 4: Supervise Rehab Work

Once you close on the purchase, the rehab work begins. This is where you, as the investor, need to manage the house rehab. I recommend that you go to the property at least once a week, as you’ll want to make sure that the work is progressing as scheduled. At these weekly meetings, I’ll walk the property with the GC and always ask two questions:

- What did you do last week, by scope of work line item?

- What are you doing this week, by scope of work line item?

These questions A) let you track the progress and make sure you hit milestones, and B) let you submit loan draw requests to pay your GC accordingly.

Occasionally, a contractor falls significantly behind schedule. When this happens, I’ll hold a status of rehab work meeting. In this meeting, we’ll discuss a plan for the contractor to catch back up on the work. If not possible, I will bring in the back-up contractor to finish the work. However, I will definitely provide some time liberties if a delay is documented by third parties (e.g. a city delaying permit issuance).

What Rehab Work Adds the Most Value?

Now that I’ve outlined the entire rehab process, I want to drill down into a closely related question: where should I focus my rehab projects to increase value. As outlined, successfully managing a house rehab starts before anyone swings a hammer. You’ll lay the foundation of a successful rehab while building the scope of work with your GC. And, during this planning, you can unintentionally undercut a deal’s profitability. If you pour too much cost into rehab work that doesn’t add value – regardless of investing strategy – you’ll undercut the deal’s profitability. Consequently, savvy investors answer this question about adding value before starting the actual rehab work.

For fix & flip investors, answering this question proves particularly important. When investors analyze a flip deal, they need to closely balance A) rehab costs, against B) after-rehab values, or ARV.

The Danger in Chasing ARV

The larger the appraised ARV, the larger the hard money loan investors can secure for a purchase and rehab (NOTE: The Investor's Edge issues hard money loans up to 75% loan-to-value based on a property’s ARV). And, as ARV depends largely on a detailed contractor bid for what rehab work will occur, this creates a dangerous assumption: if I just spend more on the rehab, the ARV will increase, and I will qualify for a larger loan!

This assumption rests on faulty logic – that value will continue to increase as rehab costs increase. In reality, local market conditions – as discussed above – will dictate a value “ceiling.” Once you hit that point, values simply won’t increase substantially, regardless of your added rehab costs. Consequently, fix & flip investors need to narrowly focus their rehab costs on projects that will increase value. This allows investors to A) maximize home value, while B) not spending money on rehab work that will not drive a return on investment.

Focus on Kitchens and Bathrooms

Regardless of the local market, renovating two areas will consistently provide you the most value “bang for your buck” – kitchens and bathrooms. This largely comes down to human nature. Simply put, people appreciate a finer feel to these rooms. When guests visit, they tend to congregate in kitchens and need to use bathrooms.

As a result, when potential buyers tour a home, they normally focus their attention on kitchens and bathrooms. Sure, a nice living room helps. But, in most cases, a high-quality, beautiful kitchen and stylish bathrooms will set a home apart from others. That is, all else being equal, nicer kitchens and bathrooms will lead to people buying one home over another comparable one.

For investors, this reality should guide your rehab budget. If you’re torn between allocating $10,000 towards finishing a basement or improving a kitchen, the kitchen rehab will usually generate more value.

A Note for BRRR Investors

BRRR investors 1) buy, 2) rehab, 3) rent, and 4) refinance properties. As such, they look to purchase similar properties to fix & flip investors, that is, distressed homes at a discount. But, when it comes to adding value with rehab projects, BRRR investors have some unique considerations due to the fact that they rent renovated properties. They don’t sell them for a profit like fix & flip investors.

Accordingly, when it comes to rehabbing a rental property, I take a different approach than with a fix & flip house. And, how I address a particular property largely depends on the market. If renters in a certain area expect a given style and amenity level, you’d hurt your rental prospects not meeting those levels.

Having said that, here’s my general philosophy when it comes to rehabbing a rental: quality of materials matters more than quality of work. With quality of work, I don’t need to pay a master carpenter to create intricate woodwork throughout the rental property. The benefits just don’t outweigh the costs. But, I do want to make sure all of the materials my contractors use will stand up to the wear and tear inherent to a rental property – hence, quality of materials.

In a rental, you also don’t want appliances and other materials that’ll fall apart quickly. For example, when I redo rental property walls, I make sure to use a very heavy texture. That way, if a tenant scuffs it up, it’ll still look good when I repaint it. You want to find the perfect balance between longevity and cost. In other words, you need to stay within your budget while making sure you won’t need to replace items every year. As a landlord, you want to do as few repairs as possible. And, by purchasing higher quality materials up front, you’ll save on back end repairs.

With respect to style, your property doesn’t need to be something out of an interior design magazine photoshoot. But, as stated, the style needs to A) generally fit the standards of the market, and B) appeal to potential tenants. You may get a great deal on high-quality materials, but if your rental looks like something out of the 1970s, you’ll struggle to lease it.

Bottom line, BRRR investors cannot solely chase added value. While rehabbing a home, these investors also need to account for tenant preferences and material durability.

Managing the Actual House Rehab

Once you’ve built the scope of work – with a focus on value-adding renovations – and signed the services contract, you need to turn your attention to managing the actual house rehab. This doesn’t mean that, as an investor, you need to spend every day at the property. That’s why you hire a GC. But, you do need to supervise that GC. In addition to the weekly scope of work check-ins I outlined above, here are a few strategies that help investors manage the rehab process. More precisely, they’re a few best-practice tips for working with GCs:

Don’t Use Allowances

An allowance functions like a placeholder on a scope of work form. For example, if you don’t confirm the costs of kitchen appliances, some GCs request an allowance for that line item. Basically, placeholders work like fuzzy budgets. When the GC ultimately buys those appliances, the costs may be significantly higher than the allowance, potentially breaking the deal’s budget.

Instead, make sure to spend the up-front time and effort at the above pricing meetings. It may seem like a ton of work, but you’ll save yourself significant frustration – and costs – during the actual rehab period.

Document Everything

In addition to documenting all work up-front with your scope of work and services contract, you’ll also want to document everything that happens during the rehab process. In addition to monitoring scope of work progress, you should also log the below information:

- Questions you ask your contractor

- Answers to these questions

- Product order numbers

- Future delivery dates

- Any major deviations from the plan, as outlined in the services contract

This log will help keep you organized, and it’ll serve as a record of conversations you’ve had with your GC. This documentation can help you resolve disputes down the road, as well.

Insist on Change Orders

Even the most experienced investors hit bumps in the road. That is, during a renovation, unexpected issues inevitably arise. When this happens, you need to adjust the original scope of work. But, these adjustments should never be casually made. Rather, insist on completing a change order, a formal contract outlining exactly what changes need to occur – and the associated costs. Experienced investors put the same level of detail into a change order as the original scope of work.

Alternatively, failing to issue a formal change order can lead to major conflicts with a GC – with regard to costs, timelines, and standards. Rather than risk these negative outcomes, just take the time to complete a change order when something unexpected happens.

Trust – but Verify

As an investor, it’s your property on the line – not the GC’s. Yes, you absolutely want to ask your contractor about progress, but you’ll also want to confirm that work personally. I like to do this by doing a property walk immediately after every scope of work status check I have with the GC. This lets me confirm that what the contractor says is complete is actually complete.

Alternatively, you can do a “walking” status check. Rather than just talking through each scope of work item, you can have your GC show you progress on every item by walking the property with you. Just establish this standard at the beginning of the process, and your GC will expect it.

Only Pay for Completed Work

I explained this above, but it’s worth reiterating: only pay for completed work. This accomplishes two important things. First, you establish a clear standard with your GC that, to be paid, scope of work line items must be 100% completed.

Second, you avoid potentially costly lawsuits. Most GCs are good people. But, if you end up with an unethical one, he or she could argue that work has been finished, when in fact it hasn’t. Yes, you can sue in these situations, but there’s no guarantee you’ll win, and with lawsuits, everyone loses time and money. Avoid these situations by only paying for work when it’s been completed – to the standard outlined in your scope of work.

How Do Hard Money Can Help

Project Managers

Even after outlining the above, I know that rehabbing a house can overwhelm new investors. To help, The Investor's Edge provides project management (PM) mentors to our investors. These PMs will guide you through the entire rehab process – from initial estimates to scope of work to completed rehab. This professional support can be a huge confidence booster for new investors. And, after doing a deal or two with this PM support, you’ll have the skills and experience to start knocking out deals on your own.

Investor’s Edge

In analyzing any deal involving a rehab, investors need access to relevant property comps. Real estate agents can access most of this information on the Multiple Listing Service (MLS), but most investors need to find an alternative database.

At Do Hard Money, we absolutely recommend our own software, Investor’s Edge. Yes, we’re biased, but we firmly believe that we’re justified in this bias. We poured our entire team’s collective real estate experience into creating the best software for investors. This program provides you access to over 90% of the MLS data in the US market, to include tax records, active properties, and sold property information. Simply put, Investor’s Edge provides you the MLS data you need to make informed real estate investment decisions.

Profit Calculator / Advanced Deal Analyzer

Calculating the profit on a house flip may seem straightforward on paper. In reality, accurately estimating all of a deal’s numbers can be extremely challenging for new (and experienced) investors. As a result, we’ve developed the Advanced Deal Analyzer, a house flipping profit calculator. This proprietary tool does all a deal’s calculations for you, quickly telling you whether a deal will be profitable or not.

With our calculator, investors just need to enter a property’s 1) purchase price, and 2) repair costs. The calculator interacts with our massive database of properties and historical transactions to do everything else. Specifically, after entering these two inputs, the Advanced Deal Analyzer will tell you:

- Whether or not a deal will be profitable

- How much profit you can make

- How much hard money you can qualify to borrow for a deal

These results save a tremendous amount of time by providing a quick assessment of profitability. And, the Analyzer also gives you a detailed breakdown of projected costs. This breakdown gives key insight into a deal’s costs. You can use this insight to maximize your profit by seeing where and how to best commit funds to a deal.

Final Thoughts

Managing a house rehab can overwhelm new investors. But, this part of your first deal doesn’t need to be an insurmountable obstacle. By A) putting in the up-front work creating a detailed scope of work, and B) heeding the above best-practice tips for supervising GCs, new investors can successfully tackle their first house rehabs.

To learn more about Fix & Flips, sign up for our free webinar.