New real investors can choose from a variety of real estate strategies. From fix & flip to BRRR to buy and hold, multiple options exist. But, for new investors – especially ones looking to gain experience and some start-up cash – wholesaling can be a great option. With that said, I’ll use this article to provide some lessons on this investing strategy – call it Wholesaling Houses 101: The Complete Guide!

With wholesaling, investors don’t actually buy a home. Instead, they find a distressed property, put it under contract, and assign the contract to a fix & flip investor for a fee. As such, these investors A) learn about fix & flips, B) make money on deals, but C) don’t need to do the actual rehab.

In the rest of the article, I’ll dive into the details of wholesaling houses. Specifically, I’ll cover these topics:

- An Overview of Wholesaling Houses

- Major Advantages to the Wholesaling Strategy

- How to Find Wholesale Deals

- Marketing Wholesale Deals to Fix & Flip Investors

- Where Wholesaling Fits Into the Real Estate Investor Progression

- Final Thoughts

An Overview of Wholesaling Houses 101

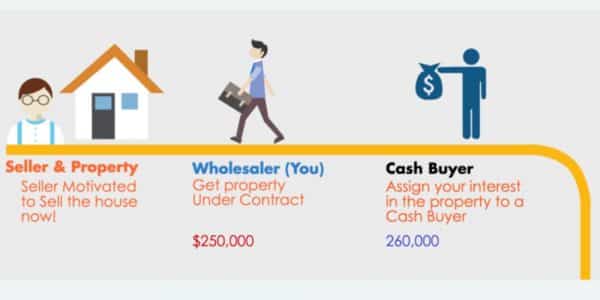

When wholesaling houses, you don’t purchase an investment property. Instead, wholesalers find off-market properties, and they enter contracts to purchase these properties. Rather than close on the purchases, they assign the contracts to a third party, typically a fix & flip investor. And, they assign these contracts for a fee. In a nutshell, wholesalers find deals, connect the sellers with investors, and collect a fee in the process – all without dealing with the headaches of doing any rehab work themselves. In other words, wholesalers complete these four steps in every deal:

- Step 1: Find solid off-market deals, ones that will appeal to fix & flip investors.

- Step 2: The wholesaler then goes under contract to purchase the home, typically a distressed property.

- Step 3: The wholesaler then shops the contract/deal around to potential buyers, generally house flippers.

- Step 4: With a third-party buyer confirmed, the wholesaler assigns the new buyer the contract rights and obligations – for a fee. This new buyer then carries out the remainder of the closing process and actually purchases the home.

When you wholesale, you learn very quickly how to spot good deals for fix & flip investors. If you don’t find good deals, you won’t be able to assign contracts to these people. Simply put, you learn what to look for in a property. Additionally, you have to work closely with house flippers. This gives you the added benefit of learning from them. Pick these people’s brains. They have tons of experience, and you can learn from it. Lastly, wholesaling puts money in your pocket. If disciplined, you can allocate a portion of these funds for a down payment to purchase your own fix & flip property.

Major Advantages to the Wholesaling Strategy

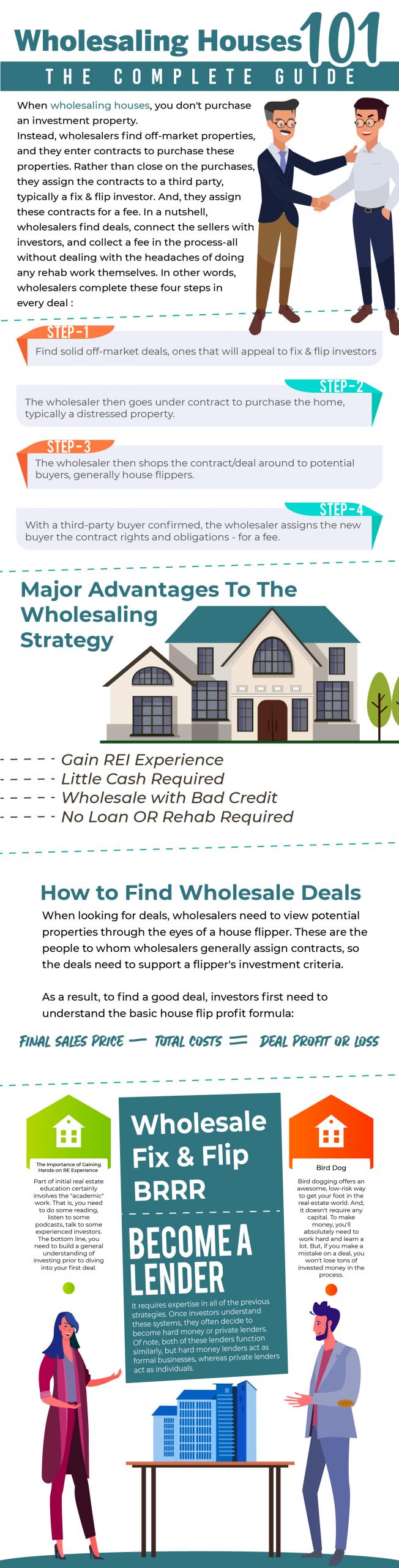

Before going into the detailed considerations to wholesaling, I want to outline the major benefits to this investing strategy. In particular, wholesaling offers four great advantages:

Gain Real Estate Investing Experience

One of the primary advantages to wholesaling is that it provides new investors an incredible amount of experience while limiting risk. Typically, wholesalers assign their contracts to fix & flip investors. As such, wholesalers need to understand exactly what these investors look for in a successful flip deal. If wholesalers put a property under contract that doesn’t meet fix & flip investment criteria, they won’t be able to assign the contract.

This reality means that wholesalers need to learn how to research and analyze deals in the same fashion as fix & flip investors. Actually, they need to find better deals, as the numbers need to support the wholesaler’s and flipper’s profit margins. But, wholesalers have the benefit of finding these deals without the added rehab, holding, and resale risk that comes with a full flip deal.

Little Cash Required

Additionally, wholesalers need very little cash to begin this strategy. I won’t say they don’t need any cash. Realistically, wholesalers will likely want $2,000 to $3,000 for up-front software, marketing, and other admin costs. But, they definitely don’t need tens or hundreds of thousands of dollars to pursue this strategy.

This low financial barrier to entry makes wholesaling extremely appealing to new investors. You can get your foot in the real estate door, gain some experience, and put some money in your pocket – all without needing a ton of initial capital.

Can Wholesale with Bad Credit

Wholesaling also opens investing doors to people with bad credit. Most traditional lenders won’t approve loans for people with poor credit scores. This makes strategies like buy and hold real estate next to impossible if you don’t have great credit.

On the other hand, with wholesaling, you don’t actually purchase an investment property. This means you have no need to apply and qualify for financing. Instead, wholesalers find deals, connect the sellers with investors, and collect a fee in the process – all without dealing with the headaches and credit requirements of qualifying for a mortgage.

Can Wholesale with Minor Criminal Records

Similar to bad credit scores, criminal records will likely prevent you from qualifying for traditional financing. And, most hard money lenders will need to closely review criminal records on a case-by-case basis to consider approving a loan. With wholesaling, you can find and put deals under contract without needing to go through the criminal background check any loan application would require.

However, if you’ve committed a crime of moral turpitude or one that’s financial in nature, you’ll still likely struggle to find willing investors to take contracts off your hands.

How to Find Wholesale Deals

When looking for deals, wholesalers need to view potential properties through the eyes of a house flipper. These are the people to whom wholesalers generally assign contracts, so the deals need to support a flipper’s investment criteria. As a result, to find a good deal, investors first need to understand the basic house flip profit formula:

Final sales price

MINUS

Total costs (Purchase price PLUS rehab costs PLUS holding costs PLUS transaction costs)

EQUALS

Deal profit or loss

This formula frames any deal analysis. Simply put, investors look for deals that A) result in a final profit, and B) ideally, have total costs less than 70% of ARV, which allows for 100% hard money financing.

Typically, wholesalers will not find distressed properties that meet these criteria on the Multiple Listing Service, or MLS. These properties generally list at retail and require little to no renovation, making them a poor fit for house flippers. Consequently, successful wholesalers build strategies to 1) find potential off-market deals, 2) market to owners, 3) set up interviews, and 4) convince owners to actually sell their properties. I highly recommend using our Investor’s Edge software for this process. This software helps wholesalers do the following:

- Find deals: We include a database of over 160 million properties, giving you massive deal potential. And, we include information about how much equity owners have in these properties. This will help you find potentially motivated sellers – all from the comfort of home.

- Save preferences: As you filter through hundreds of potential deals, you need to stay organized. If not, you’ll quickly become overwhelmed – or simply commit far more time than necessary. Our software lets you save all of your preferences with a click, keeping you organized and focused on what matters – closing deals!

- Market instantly: Once you find a deal, you still need to contact the owner. With Investor’s Edge, you can automate this process. Our software lets you print postcards with pre-filled addresses and send voicemails to your saved list of potential deals.

But, you’re not done after this initial outreach. Once you connect with a potential seller, you still need to convince him or her to sell. I like to look at this as problem solving. Typically, motivated sellers have a need that they must meet. Frequently, they need cash for something or other but can’t sell their house due to its current condition. It may be significantly distressed, or it may just require a major repair that the owner cannot afford.

As a result, these owners can only sell to all-cash or hard money loan investors. Enter you as the problem solver. You can put this property under contract, and the house flipper then provides the owner the cash he or she needs. But, I always want to emphasize to new investors: don’t pretend you’re doing this out of the goodness of your heart. This is disingenuous, as you’re doing it to profit – not for charity. Rather, you’re looking for a win-win situation. By putting the home under contract, you solve the owner’s cash-need problem. But, you also gain a good wholesale deal in the process. Win-win.

Here’s the major takeaway: when looking for properties, remember that you’re a problem solver. But, to solve problems, you must first understand the seller’s needs. If you take the time and effort to do this – which requires a little empathy and communication – you’ll find great deals. And, you’ll help people out in the process.

As you research potential deals, you’ll eventually find one that looks like a winner. At this point, you’ll estimate a flip budget using rough numbers. For wholesalers, it’s not critical that the numbers be precise. Instead, your back-of-the-napkin budget will let you know whether you should put the property under contract. The house flipper will then confirm a refined rehab budget once he or she takes over your contract.

Marketing Wholesale Deals to Fix & Flip Investors

With wholesaling, finding good deals only represents one part of the equation. If you don’t have another investor to take over the contract, the deal collapses. This reality makes marketing to investors willing to purchase these contracts absolutely critical to the wholesaling strategy. Recognizing this importance, I recommend a couple marketing strategies for finding these investors:

Marketing Technique #1: Cash Buyers List

With traditional mortgages, lenders will not approve the financing of a distressed property. These sorts of homes pose too much collateral risk for lenders, so investors need to either A) use hard money loans, or B) purchase distressed properties with cash.

Recognizing that many fix & flip investors purchase homes with cash, wholesalers can create a cash buyers list. Basically, this is a tracker of all people who’ve bought properties for cash in the same zip code over the last year. Armed with this information, wholesalers can narrow down their list of potential buyers to motivated leads – people looking for similar properties. And, once they find a deal, wholesalers can reach out to these cash buyers directly, a far more efficient process than marketing to all potential buyers.

Marketing Technique #2: Reverse Marketing

With this technique, you reverse the sequencing of a deal. Instead of finding a deal and then finding a buyer, you find the buyer and then find the deal. Essentially, reverse marketing means finding motivated buyers – typically fix & flip investors – and asking what they’re looking for in terms of property and price, and then going out to find those deals. That way, you’ve already secured a buyer before putting a property under contract. As soon as you sign the contract, you contact the buyer, explain that you’ve found a property meeting his or her requirements, and then you assign the contract.

Where Wholesaling Fits Into the Real Estate Investor Progression

I don’t view wholesaling as a stand-alone real estate investment strategy. Rather, I believe it fits into a broader progression of strategies that most investors take, with each one building on the last. And, to truly understand wholesaling, investors should know where this strategy fits into that broader investment progression.

The Importance of Gaining Hands-on Real Estate Experience

Part of initial real estate education certainly involves the “academic” work. That is, you need to do some reading, listen to some podcasts, talk to some experienced investors. Bottom line, you need to build a general understanding of investing prior to diving into your first deal.

But, this “bookwork” can only take you so far. Eventually, to grow as an investor, you need to start getting actual experience. As the saying goes, good judgment comes from experience, and experience comes from bad judgment. You have to get your hands dirty, make some mistakes, and learn from those mistakes to gain experience.

However, this doesn’t mean you should try to start your real estate journey by developing a 250-unit apartment building. Instead, a common – and logical – investment experience path exists. While you don’t need to follow these steps exactly, the following investment strategies help you walk through the “investor lifecycle.” Each strategy is more complicated than the prior one, so learning them in a step-by-step approach allows you to gradually build your experience.

Bird Dog

Bird dogging offers an awesome, low-risk way to get your foot in the real estate world. And, it doesn’t require any capital. To make money, you’ll absolutely need to work hard and learn a lot. But, if you make a mistake on a deal, you won’t lose tons of invested money in the process.

Here’s how it works. A lot of real estate investors make money through wholesaling. But, wholesaling requires investors to find deals to bring to other investors. While the wholesalers themselves can certainly do this searching legwork, they often pay other people – bird doggers – to do it for them.

Bird doggers spend their time looking for a certain sort of deal. They want to find distressed properties that won’t qualify for traditional financing. In other words, traditional mortgage lenders want to make sure a house is actually habitable. Bird doggers look for properties that don’t meet this standard. Next, the owners of these properties need to have A) some equity in the property, and B) some reason for wanting to sell – often to turn that equity into cash.

As bird doggers find leads on situations like this, they pass them along to wholesalers for a fee. They may receive a fee for every lead, or it could be a contingent payment based on the lead actually converting. It ultimately depends on the relationship you have with a particular wholesaler. But, regardless of payment structure, bird dogging provides you an outstanding opportunity to gain some real estate investing experience with little to no barrier to entry.

Wholesale

Once you’ve bird dogged for a while, you can make the jump into wholesaling properties yourself. I’ve covered the ins and outs of wholesaling in the above sections. Of note, gaining A) experience and B) some start-up capital by wholesaling puts you in a position to make the jump into the next strategy.

Fix & Flip

As a fix & flip investor, you need to understand everything wholesalers do about finding good deals. But, you also need to understand how to rehab and sell these properties. Broadly speaking, the fix & flip strategy works like this:

- Step 1, Find a distressed property: Investors need to find properties that need rehab work to qualify for traditional financing. And, these properties need to make financial sense. That is, the purchase price and all rehab-related costs need to be less than the projected final sale price to make a profit.

- Step 2, Rehab the property: After purchasing a distressed property, house flippers need to renovate it to a standard that A) qualifies for a traditional mortgage, and B) appeals to potential buyers in that particular market. This requires an in-depth understanding of renovations, working with contractors, and creating accurate rehab budgets.

- Step 3, Sell the property: Finally, house flippers need to sell the property. Typically, these investors sell to primary homebuyers. That is, they sell to people looking to buy their home – not an investment property. This requires an understanding of sales and pricing strategies, and a solid analysis of the local market.

The above provides a simplified overview of the house flipping system. However, it should be clear – this strategy takes far more knowledge and experience than bird dogging or wholesaling. But, it also provides investors far greater returns. And, during the house flipping process, you’ll inevitably make mistakes. As you work through a few deals, you’ll quickly gain a tremendous amount of experience.

BRRR

After gaining experience in the fix & flip world, many investors make the jump into the BRRR strategy. This requires all of the experience and knowledge of flippers, but now you also need to understand property management and permanent financing. Here are the steps that make up the BRRR strategy:

- Buy: Investors buy distressed properties – ideally at a deep discount – in need of major repairs. As such, BRRR investors largely look for the same properties as fix & flip investors.

- Rehab: Investors then rehab the property. However, they don’t rehab it to sell it. Rather, they do their renovations with an aim to appeal to renters. Rehabbing a rental property usually means picking far more durable materials than if rehabbing for sale. You’ll need materials that can handle the wear and tear of multiple tenants. And, you don’t want to have to complete repairs every year. This rehab leads directly into the next step of the strategy.

- Rent: Once you’ve completed the renovation, you need to market the property for rent and secure quality tenants. You can certainly hire a property manager to do this. This saves you a ton of headaches, but it also costs money. And, from an experience perspective, I recommend investors manage at least one of their own properties. This provides you a solid understanding of the leasing and property management process, and you’ll be better positioned to hire and supervise property management companies down the line.

- Refinance: Once you’ve rehabbed the property and signed a tenant lease, you can refinance the property. Typically, BRRR investors (and flippers) use hard money loans to finance a property purchase and rehab. However, these loans have high interest rates, as they’re designed for short-term investment use. Once a property meets traditional mortgage quality standards and is rented out, you’ll want to refinance into a traditional mortgage. This new loan will pay off the outstanding hard money loan.

As these steps illustrate, BRRR investing requires all the experience and knowledge of flipping homes, with two additional wrinkles. These investors need to understand property management, and they need to have a better grasp of real estate financing. The success of the strategy hinges on refinancing, so that’s crucial knowledge.

However, while requiring more experience, this strategy also provides more profit. With a house flip, you have one-and-done profit. That is, once you sell a property, that’s how much you make – for better or worse. BRRR investing creates long-term wealth. More precisely, in a BRRR deal, you continue to make money in three ways.

First, you pocket any rent payments in excess of operating expenses and debt service. Second, you gradually build equity in the property as your tenants’ payments pay down the amortizing mortgage. And, third, houses appreciate over time. While they may fluctuate in the short-term, over time (especially a 30-year mortgage horizon), home appreciation historically has outpaced inflation.

Become a Lender

The final step in the residential real estate investing progression requires expertise in all of the previous strategies. Once investors understand these systems, they often decide to become hard money or private lenders. Of note, both of these lenders function similarly, but hard money lenders act as formal businesses, whereas private lenders act as individuals.

At face value, lenders appear to do far less work. And, in some ways, they do. Lend money, sit back, and profit. But, to do that successfully, you need to have an in-depth understanding of how to analyze deals. Lenders only make money on successful deals. If you lend to anyone for any deal, you’ll fail. As such, before issuing loans, these lenders need to fully analyze a deal – the same way they would as a fix & flip or BRRR investor. However, now the loan interest is their income – not expense.

But, lenders need to know more than just analyzing deals. They also need to understand the legal, administrative, and financial requirements of originating and administering loans. And, unfortunately, part of this means understanding the foreclosure process, as well. Proper up-front due diligence mitigates the likelihood of a borrower foreclosure. But, sometimes a series of unfortunate incidents leads to borrower default. As a lender in this situation, you need to be prepared to execute foreclosure procedures to recoup as much loan principal as possible.

Final Thoughts

For new investors, wholesaling houses can be a great way to get your foot in the real estate door. This strategy requires very little up-front capital, and it provides investors tremendous experience. If done correctly, you can leverage the profits and experience from wholesaling to continue climbing up the real estate progression ladder. Simply put, wholesaling provides investors a solid foundation to move onto more advanced investing strategies (e.g. house flipping, BRRR deals, and private lending).

If you want to get started as a wholesaler, drop us a note. We love helping new investors, and we have plenty of mentors to help guide you through your first few deals.

For more information on wholesaling, sign up for our free webinar.