What Exactly Does 100% Financing Mean in the Fix & Flip World?

Life would be easy if we all the same definitions for things, right?

Unfortunately, an eye-popping claim like “100% financing!” means different things to different people and organizations.

Some hard money lenders will use it to mean they’ll pay 100% of the purchase price (but not the rehab), or even that they’ll pay 100% of the rehab, but only 90% of the purchase price.

It’s a little sneaky, but hey, that’s marketing, right?

Since there’s a need for clarification on this, here’s what it means to us.

Funding 100% of the Purchase and Rehab Price

When we say 100% financing, we truly mean that every last penny you need for the deal can be funded. Take Keyanna for example:

She made $25k without bringing any money to the table.

We fund deals like this all time – but of course, not every deal qualifies.

Here’s how we calculate it:

We’re willing to fund up to 70% of the after repair value (ARV) of a property.

So, let’s say we work together to estimate the ARV of your deal at $300k.

If you can fit the purchase, rehab, and other costs under $210k, we’ll pay literally every dollar of the deal. Pretty cool, huh?

Other hard money lenders won’t fund without money down (usually $20k or more) – but our industry-best evaluation process virtually guarantees a profitable deal.

Plus, we don’t just fund… we train as well.

If you’ve learned from us, and our evaluators give the green light, then why wouldn’t we fund the whole thing? There’s profit to be had!

Alternative Options That Still Require $0 Cash-to-Close

So, like I said, not every deal qualifies for us to fund the entire deal…

But there’s still a TON of profit to be made.

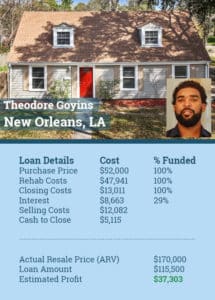

Let’s look at Theodore’s example.

He found a good deal, but the numbers didn’t quite work out for 100% financing… so he needed around $5k to finish the deal.

But he still turned that $5k into over $37k!

(How’s that for ROI?)

But then you ask…

“What if I don’t have the $5k? You said I could come with $0 cash-to-close?”

That’s true. I did say that.

That’s because we teach a variety of funding methods that can each help you complete a deal without paying a dime.

Let’s say we’ll approve you for a loan, but you still need to bring $10k to the table. Here are a few options we teach:

- Line of Credit – A bank gives you access to funds to use to pay the difference. After you sell rehab and sell the home, you pay off the line of credit – meaning you no money out of your personal account.

- Gap Funding – We pair you up with another investor to pay the difference, and you split the profit on the back end.

- Wholesaling – You get a home under contract, and then flip it to someone else in a better position to fix & flip the home!

And honestly, those are just the more common options to complete a deal with no money!

We consider ourselves deal makers… in other words, if there’s profit to be had, we’ll work with you until the deal gets done. Everything’s figure-outable.

Ready to get started? Let’s talk about options that work best for your unique situation.

Register and attend our next webinar to see how all of this works.