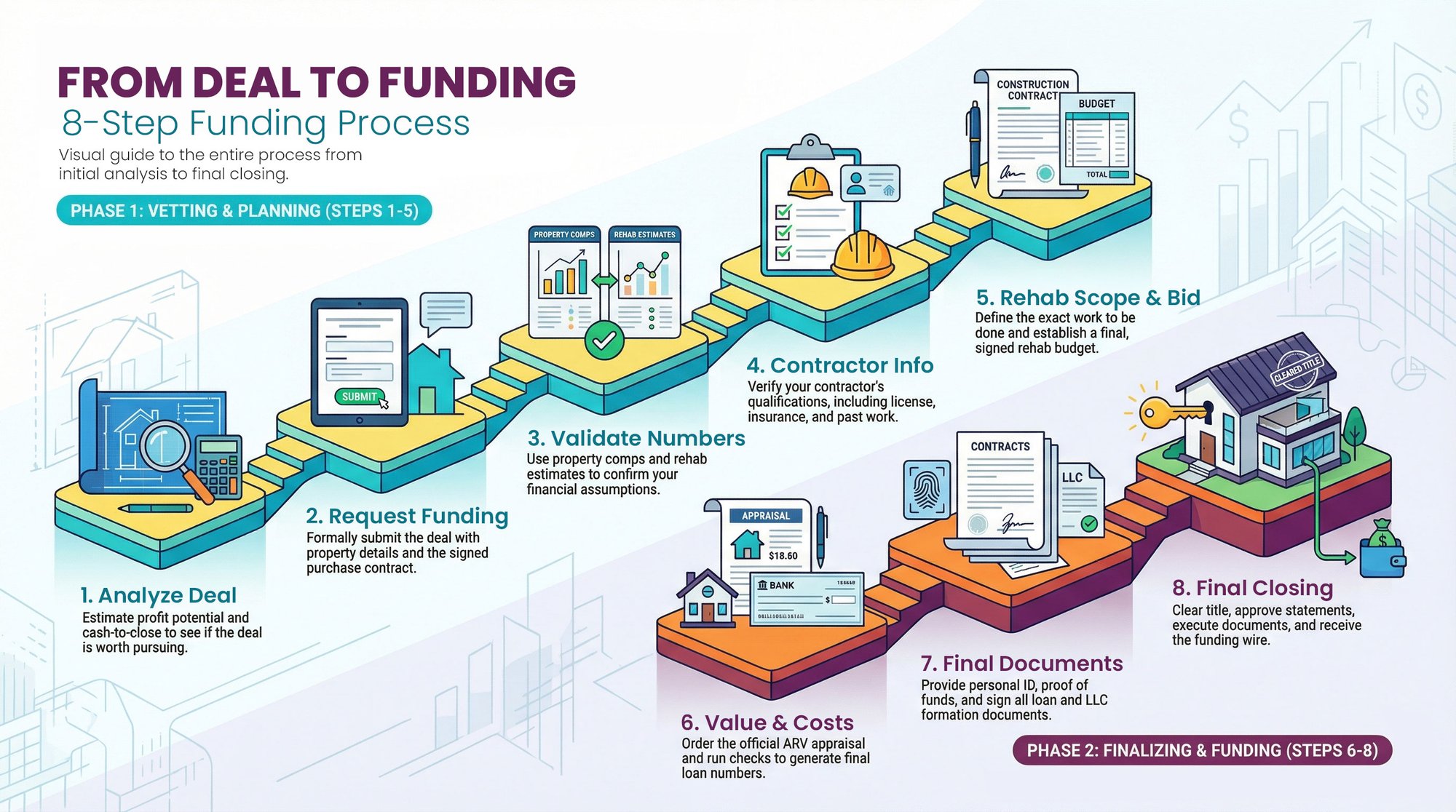

Our Funding Process

8-Step Process

A clear, step-by-step guide from deal analysis to closing. This page walks you through each step of our funding process so you always know where you are, what’s been completed, and what’s coming next. You’ll receive updates as your deal moves forward, and you can always return here as a reference.

A quick financial snapshot to see if a deal is worth pursuing.

Formal submission of the deal for funding review.

Data-backed confirmation of value and rehab assumptions.

Verification that the contractor is qualified for the scope of work.

Definition of exactly what work will be done and how much it will cost.

Final confirmation of value, risk, and loan economics.

Everything needed from you to prepare for closing.

Final coordination and funding of the deal.

The Details

Step 1: Analyze Deal

What happens: You enter basic deal details to estimate profit potential and cash-to-close. If the numbers make sense, you can convert this directly into a funding request.

The Details: This is where every deal begins. Using our Advanced Deal Analysis tool, you’ll enter the basic details of a potential property — purchase price, estimated rehab, after-repair value (ARV), and location. From this, you’ll get a quick snapshot of projected profit potential and a realistic cash-to-close range.

This step is designed to help you decide whether a deal is worth pursuing before you invest time, money, or effort. If the numbers make sense, you can convert your analysis directly into a funding request and move forward.

Step 2: Request Funding

What happens: You provide detailed property, financial, and partner information, send an offer to the seller, and upload the signed purchase contract once accepted.

The Details: Once you create a funding request, we gather the additional information needed to evaluate and structure the loan. This includes more detailed property information (size, beds, baths, condition), any known risk factors (location concerns, additions, foundation issues, fire or mold damage, etc.), your financial profile (cash available, credit range, experience, liens or bankruptcies), and details about any partners involved in the deal.

After completing the funding request, you’ll send an offer to the seller. This can be done through your agent, manually, or directly from our platform using built-in e-signature tools. Once the offer is accepted, you’ll upload the fully signed contract and confirm key details like purchase price, closing date, buyer and seller information.

Step 3: Validate Numbers

What happens: You submit comps and rehab estimates. Our team completes a desktop evaluation to establish realistic value ranges before moving deeper into the deal.

The Details: This step supports your deal assumptions with real data. First, you’ll provide comparable properties — typically two active and two sold comps — that meet reasonable standards for distance, size, age, and features. These help establish a defensible value range.

Next, you’ll estimate rehab costs using our Bluehammer rehab estimating tool. By entering basic property characteristics and finish levels, the system generates a detailed, hyper-local rehab estimate at both “economy” and “good” quality levels.

Finally, our team completes a desktop evaluation. This is a deeper review of the market, price-per-square-foot trends, and comparable properties to establish realistic high and low resale expectations. You’ll receive a PDF summary and a video walkthrough so you can see exactly how the conclusions were reached.

Step 4: Contractor Info

What happens: You submit contractor contact details, licensing, insurance, past work, references, and a signed process disclosure. This only needs to be completed once per contractor.

The Details: This step ensures the contractor is qualified for the scope of work — and only needs to be completed once. You’ll provide the contractor’s contact information, licensing (as required by the local jurisdiction), liability and workers’ compensation insurance, examples of recent similar projects, and references. We review this to confirm the contractor has experience appropriate for the size and complexity of the rehab.

The contractor also signs a disclosure acknowledging how our rehab and draw process works, including inspections, permitting requirements, and payment procedures. This alignment upfront helps avoid delays and misunderstandings later.

Step 5: Rehab Scope & Bid

What happens: We conduct a site tour, identify required inspections, create a detailed line-item scope, collect contractor pricing, review the bid, and finalize the signed rehab budget.

The Details: This step defines exactly what work will be done and how much it will cost. We begin with a virtual site tour conducted with you and your contractor. During the walkthrough, we determine the scope of work by comparing the property to the sold comps — asking what needs to be done to bring the property to a comparable condition.

Any required inspections (termite, roof, foundation, septic, etc.) are identified and completed. Once inspections are finished, our Rehab Coordinator creates a detailed, line-item scope of work and sends it to the contractor.

The contractor prices each line item directly in the system. We then review the bid to ensure pricing is realistic, market-based, and transferable if another contractor were ever needed. Once approved, the contractor signs the final bid.

Step 6: Value & Costs

What happens: We order the ARV appraisal, finalize insurance costs, review title, run credit and background checks, and generate final loan numbers for approval.

The Details: At this stage, several key items are processed in parallel. We order a subject-to-repairs ARV appraisal, which establishes the final value used for loan calculations. Loans are based on a percentage of this appraised value. At the same time, we finalize insurance costs, including hazard insurance and flood insurance if required.

A preliminary title search is completed to identify any liens, ownership issues, or encumbrances. We also run a credit check and background check. These do not determine whether you qualify for funding — they affect pricing and ensure there are no active bankruptcies, foreclosures, or disqualifying criminal issues. If needed, a qualified partner can be used.

Once all inputs are received, we generate final numbers and issue a final Letter of Intent outlining loan terms, cash-to-close, and estimated costs.

Step 7: Final Documents

What happens: You provide ID and proof of funds, sign loan documents, and execute LLC formation paperwork for the property’s special purpose entity. This step gathers everything we need from you to prepare for closing.

The Details: You’ll provide a government-issued photo ID and proof of funds for any required cash-to-close. You’ll also sign the final loan proposal, loan agreement, and forbearance agreement, which governs payment terms after the initial interest-covered period.

We also create a property-specific LLC (special purpose entity) for the deal. You’ll sign the SS-4 (EIN application), Certificate of Organization, Operating Agreement, and related LLC documents. We handle preparation and filing — you simply review and sign.

Step 8: Final Closing

What happens: Title and insurance are cleared, the settlement statement is approved, investor funding is confirmed, closing is scheduled, documents are executed, funds are wired, and rehab escrow is established.

The Details: This is the final coordination phase before funds are released. We confirm title is fully cleared, insurance is approved, and the settlement statement is reviewed and finalized. An investor from our funding pool is assigned and approved, and all wiring instructions are verified.

Once the closing package is complete, we schedule the closing with all parties. After documents are executed, funds are wired to escrow, the rehab escrow is established, and draw procedures are set up. At this point, the deal is funded and ready for work to begin.

FREQUENTLY ASKED QUESTIONS

Real estate funding can feel complex, especially when multiple steps are happening at once. This FAQ section is here to answer common questions about timing, requirements, and what to expect as your deal moves forward. If something ever feels unclear, remember that the process is designed to reduce risk, avoid surprises, and help your project succeed. And if you still have questions, our team is always here to help.

Because rehab execution is one of the biggest risks in a deal. We verify that the contractor is licensed, insured, and experienced with similar projects so your timeline, budget, and loan remain protected.

Yes. Each deal is funded through a property-specific LLC (special purpose entity). We prepare and file the LLC documents for you. You simply review and sign.

You’ll provide proof of funds during the Final Documents step. Cash-to-close is typically wired at closing, not earlier.

The appraisal is ordered during the Value & Costs step, after the rehab scope and bid are finalized. This ensures the appraisal reflects the actual planned scope of work.

Unexpected items happen in real estate. If something arises — title issues, inspection findings, appraisal questions — we’ll explain what it means, what options exist, and how it affects timing or structure.

Your deal is considered funded once closing documents are executed, funds are wired, and the rehab escrow is established. At that point, you’re cleared to begin work.

You can always see your current step and completed items in your funding dashboard. We’ll also send automated updates as milestones are reached.